By Stephen Kirk, CVS Life, FSAVE, FAIA, LEED AP – Vice President – Education, SAVE International

One of the core competencies of the value methodology is an understanding of “cost analysis” or the economics of a project, product, or process.

Several economic techniques have been addressed in this cost analysis series. These include:

This month, Sensitivity Analysis will be addressed. This is important when using any of the economic techniques listed above. Prior to selecting the preferred alternative based on the economic technique used, a sensitivity analysis is recommended. This is a simple procedure, particularly if the economic study was done on an electronic spreadsheet.

The purpose of Sensitivity Analysis is to explore variables used in the study that may cause the favored alternative to no longer be the best choice. Adjusting these variables and observing the outcome helps build confidence that the preferred alternative remains the best choice.

This effort begins by reviewing the variables that have the most significant impact on the answer. This may be the highest cost numbers. It may be the discount rate, or the analysis period used in the calculations.

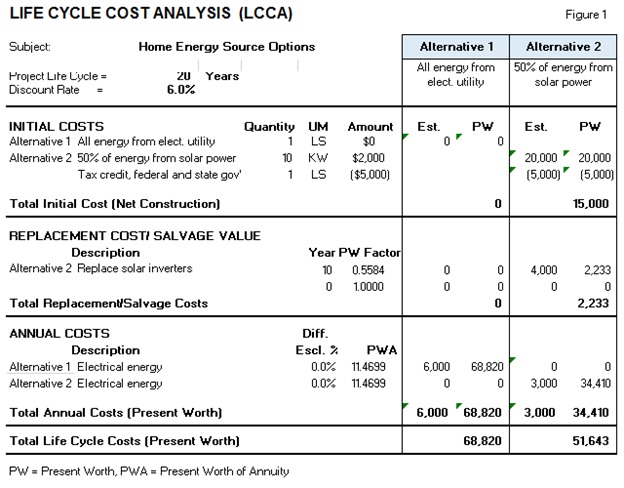

For example, in the home energy source options life cycle cost analysis presented last month (see Figure 1), observe the high costs for each alternative.

In this case the cost of the solar panels was very significant. A sensitivity analysis would consist of re-analysis of the alternatives by changing the cost of the solar panels. What if the solar panels cost, say, 20% more than what was used in the analysis? Would this change the result? What if the solar panels cost 20% less, would the result change?

Another large cost item is the cost of electricity. Again, vary the cost by 20% higher and 20% lower.

If in all the variations alternative 2 remains the preferred alternative due to the lowest life cycle cost, then the analyst has confidence in making a recommendation.

If during the sensitivity analysis it is observed that the preferred alternative switches from one to another by changing the variables, then confidence is lost. In this case, the analyst should do more research on the information used before making the final selection.

This concludes this series on economic analysis. I hope it has been beneficial to you. My term as the SAVE International Vice President – Education has now ended. I wish you every success in your continued application of these and other value methodology techniques!