By Stephen Kirk, CVS Life, FSAVE, FAIA, LEED AP – Vice President – Education, SAVE International

One of the core competencies of the Value Methodology is an understanding of “cost analysis” or the economics of a project, product or process.

Several economic techniques are being addressed in this cost analysis series. These include:

- Payback Period (see February 2018, Value World)

- Breakeven Analysis (see March 2018, Value World)

- Return on Investment (see April 2018, Value World)

- Life Cycle Cost Analysis (this month)

“Return on investment” was addressed last month. It determines the percentage of return over a given investment period. This can be calculated for each alternative. The highest percent return would be the preferred alternative, assuming non-monetary benefits are the same.

This month “life cycle costing” is discussed.

Life Cycle Cost Analysis

Life cycle cost analysis is an economic technique for determining the total cost of ownership (expressed in present worth dollars) over a selected analysis period for each alternative.

Using the example from last month, suppose a family is considering adding solar panels to their home to reduce energy costs. The alternatives being considered are as follows:

Alternative 1: Family continues to purchase all energy from the electricity utility company.

Alternative 2: Family purchases solar collector system which results in reducing the amount of purchased energy from the electrical utility company by 50%.

A solar power company informed the family their home, based on its size, would require a 10 KW system. This would cost approximately $2,000 per KW or $20,000 total. Federal and state tax credits would reduce the system cost to about $15,000. Using the solar system, the family is expected to decrease their electrical utility bills for energy by approximately $3,000 per year. There is an expected replacement cost for inverters for the solar system at year 10 of $4,000.

Let’s say the owner wants to know the life cycle cost of each alternative over 20 years. Money has the potential to earn money over time. Because of this, proper economic analysis requires future dollars to be “discounted” to equivalent present worth (today’s) cost. Economic factors are used to convert money spent to present worth. The time value of money (discount rate) is 6%. The following example illustrates the calculations required.

Example Life Cycle Cost Analysis

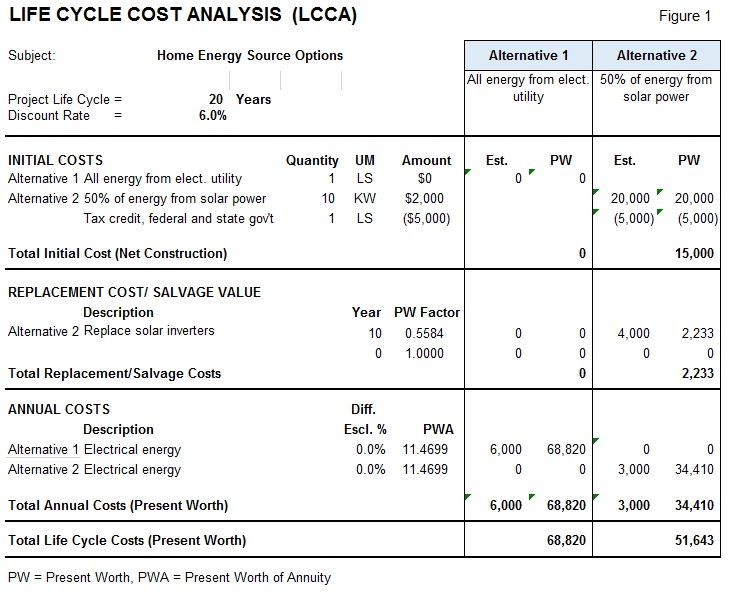

Refer to LCC worksheet, Figure 1 (below) for the example.

The initial cost is entered for each of the two alternatives. Note the cost and the column for PW (present worth) are the same as both are expressed in today’s costs.

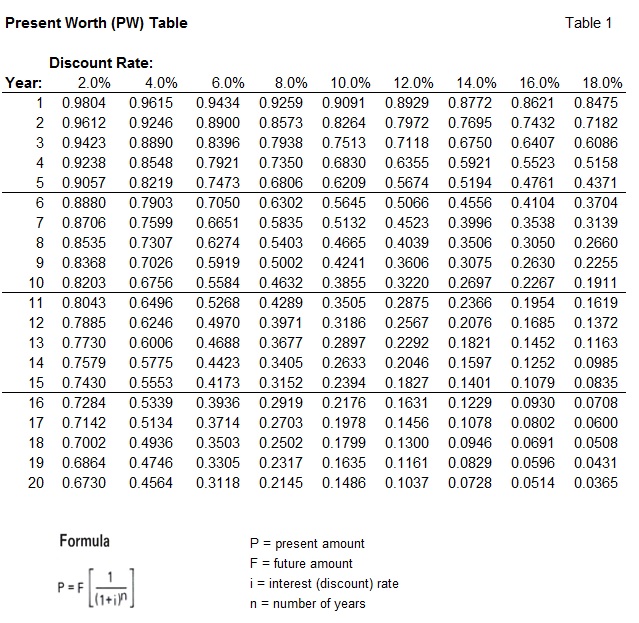

For the replacement costs, more work is required. Alternative 2 has inverters that need to be replaced on the solar collector. This is a cost of $4,000. To convert to PW requires using the PW factor shown on Table 1 (below). For a discount rate of 6% and 10 years it is 0.5584. Multiplying the $4,000 by this factor results in a PW of $2,233.

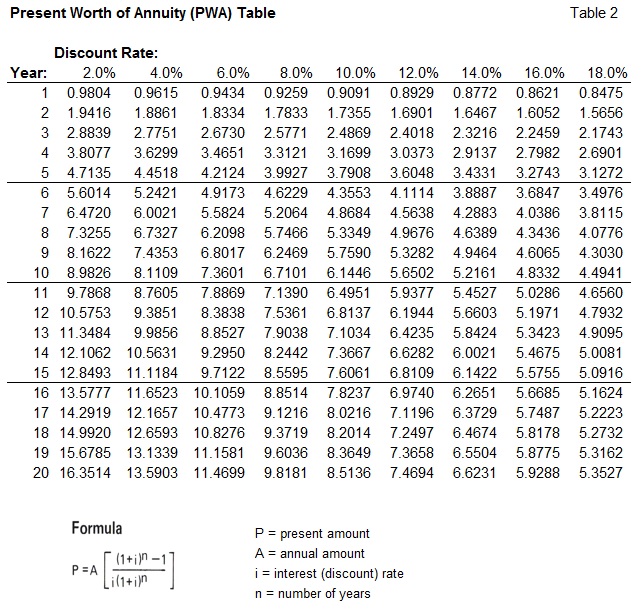

For annual costs for energy, Alternative 1 has a cost $6,000. For Alternative 2 it is $3,000. To convert these costs to PW, refer to Table 2 (below) for the present worth of annuity (PWA) factor. For a discount rate of 6% and 20 years it is 11.4699. Multiplying the $6,000 for alternative 1 by this PWA factor results in a PW of $68,820. Multiplying the $3,000 for alternative 2 by this factor results in a PW of $34,410.

Totaling the PW of initial cost, replacement cost and annual cost results in a total life cycle cost for Alternative 1 of $68,820 and Alternative 2 of $51,643.

The preferred alternative would be the lowest life cycle cost, Alternative 2, assuming non-monetary benefits are the same.

Decision Considerations

The decision as to whether to select the solar alternative has several considerations. Does the family have $15,000 to invest? Is a PW savings of $17,177 over 20 years acceptable compared with other family investment opportunities? Is the risk of the actual savings being lower than $3,000 per year resulting in a lower LCC savings still be a good choice?

How many years will the solar system last? What is the required maintenance on the solar system? Will the utility company continue to buy back excess electricity generated from the solar system? Is the family also interested in improving the environment by using solar power?